Chairman of the House Financial Services Committee, Patrick McHenry, has publicly voiced his concerns over the Notice of Proposed Rulemaking on digital asset reporting requirements issued by the U.S. Department of the Treasury and the Internal Revenue Service (IRS). The proposed regulations, which were announced on August 25, 2023, are part of the Infrastructure Investment and Jobs Act.

Chairman McHenry stated, “The notice of proposed rulemaking on digital asset reporting requirements is another front in the Biden Administration’s ongoing attack on the digital asset ecosystem.” He emphasized that following the passage of the Infrastructure Investment and Jobs Act, lawmakers from both parties had clearly expressed that any proposed rule should be “narrow, tailored, and clear.”

While McHenry acknowledged the delayed effective date and exemptions for other activities in the proposed rule, which he said mirrored his bipartisan bill, the “Keep Innovation in America Act,” he also pointed out its shortcomings. “However, it fails on numerous other counts. Any additional rulemakings related to the other sections from the law must adhere to Congressional intent,” he added.

The Chairman further urged the Biden Administration to cease its efforts to undermine the digital asset ecosystem in the U.S. and collaborate with Congress to establish clear regulations for the industry. He expressed his commitment to advancing his bipartisan solution, the “Keep Innovation in America Act,” to rectify these reporting requirements, safeguard the privacy of market participants, and ensure the digital asset ecosystem thrives in the U.S.

Chairman McHenry is the lead sponsor of H.R. 1414, the “Keep Innovation in America Act,” which aims to amend the digital asset reporting provisions in the Infrastructure Investment and Jobs Act. The bill has garnered support from a bipartisan group of colleagues, including Rep. Ritchie Torres (NY-15).

For context, the proposed regulations by the Treasury and IRS aim to mandate brokers to report sales and exchanges of digital assets conducted by their customers. The regulations are designed to address ambiguities surrounding digital assets, including defining brokers and introducing a new reporting form, Form 1099-DA. IRS Commissioner Danny Werfel commented on the regulations, emphasizing their design to “end confusion involving digital assets” and ensure that “digital assets are not used to hide taxable income.”

Public feedback on these proposed regulations is open until October 30, 2023, with a public hearing scheduled for November 7, 2023.

There are widespread criticisms regarding the proposed regulations, in addition to those expressed by Chairman McHenry. Chye-Ching Huang from the Tax Law Center at NYU Law voiced concerns with an article titled “U.S. Will Likely Lose Billions Due to Unacceptably Long Delay for Digital Asset Reporting Requirements“, over the “unacceptably long delay” in releasing the proposed rules. The Center pointed out the decision to postpone full implementation of these requirements until 2026, a two-year delay from the original statute. They warned of the financial implications of this delay, suggesting that the Treasury and IRS might lose out on billions due to tax non-compliance for digital asset transactions in 2023 and 2024.

The Tax Law Center further emphasized that the Treasury and IRS had other viable options to implement these reporting requirements in a timely manner, allowing for public input and system development.

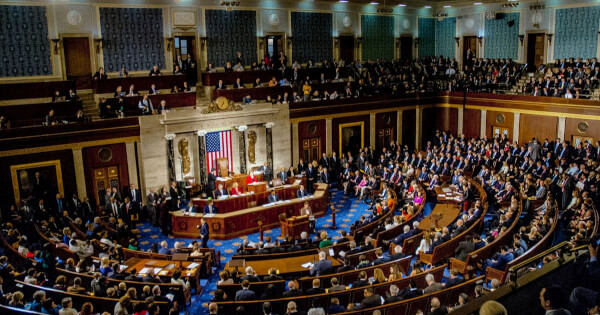

Image source: Shutterstock