As the crypto sector has seen an uplift recently, traders have been wondering if the altcoin season is here. Here’s what Glassnode says.

Glassnode’s Altcoin Season Indicator Shows Largest Risk-On Signal In 2 Years

In its latest weekly report, the on-chain analytics firm Glassnode has discussed what the altcoin market is looking like right now. Earlier, the firm had devised an “Altseason Indicator,” which, as its name already implies, monitors the rotation of capital happening toward the altcoins.

Note that “alts” here refer to all cryptocurrencies that aren’t Bitcoin, Ethereum, and the stablecoins. The Altseason Indicator works by checking for two conditions.

First, it confirms whether the three major asset classes in the sector (BTC, ETH, and the stables, as mentioned before) are receiving capital inflows. The metric uses the realized cap of the former two cryptocurrencies and the latter’s supply to track the changes.

“Historically, Bitcoin tends to lead the digital asset market, with market confidence then flowing towards Ethereum, and then further out on the risk curve from there,” explains Glassnode.

Thus, inflows into all three are when the market is starting to show a risk-on approach. The second thing that the Altseason Indicator checks is the momentum in the total market cap of the altcoins.

More specifically, the metric finds whether the total valuation of the alt sector is more than its 30-day simple moving average (SMA) or not. When these two conditions turn green together, the Altseason Indicator suggests the presence of a risk-on environment.

Now, here is a chart that shows the instances where the Altseason Indicator flashed positive during the past few years:

Looks like the metric has been giving a green signal in recent days | Source: Glassnode's The Week Onchain - Week 44, 2023

As displayed in the above graph, the Altseason indicator turned positive on 20th October. What followed this was Bitcoin’s astonishing run from $29,500 to $35,000, and along with this rally, the rest of the sector also enjoyed an uplift.

Interestingly, the indicator has remained green since it first went off on the date above, which means that the market has now been in risk-on mode for the longest duration since November 2021.

November 2021 was when the market had observed the peak of this cycle’s bull run. The Altcoin Season remaining positive recently naturally shows the confidence that the investors have in the alts right now.

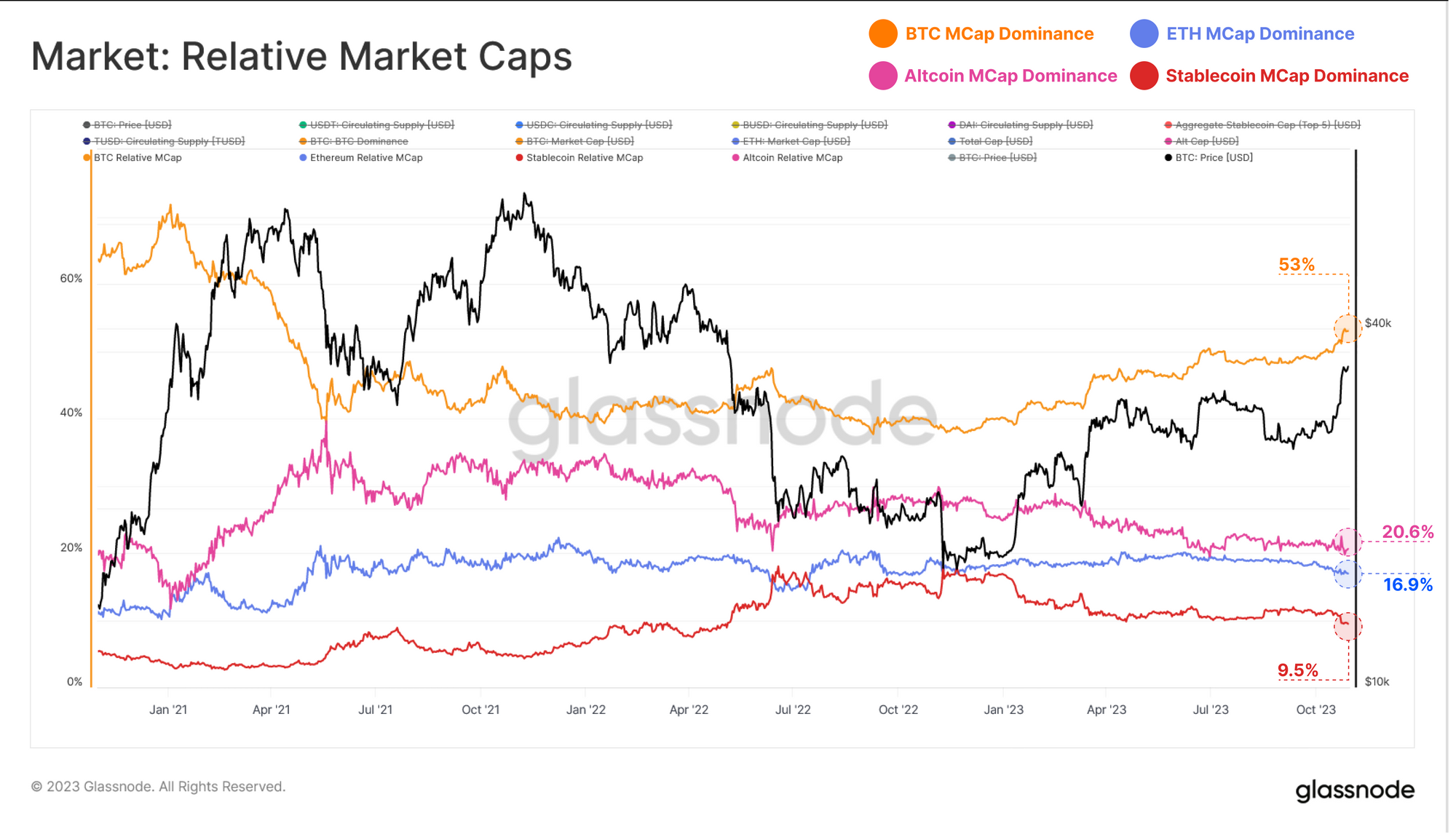

Glassnode suggests, though, that while there is an altseason present in terms of the USD, there isn’t one in BTC yet. As the below chart highlights, Bitcoin’s dominance has continued to grow recently.

The relative market caps of the different asset classes in the sector | Source: Glassnode's The Week Onchain - Week 44, 2023

“On a relative basis, BTC now commands over 53% of the digital asset market valuation, with Ethereum, Altcoins at large, and stablecoins all seeing a relative decline in their dominance throughout 2023,” notes the report. “Bitcoin dominance has increased from a cyclical low of 38% hit in late 2022.”

BTC Price

Bitcoin had surged above $35,000 during the past day, but the asset has seen a pullback in the last few hours as it’s now below the mark again.

BTC has enjoyed some uptrend over the last 24 hours | Source: BTCUSD on TradingView

Featured image from Shutterstock.com, charts from TradingView.com, Glassnode.com